Insurance paid by Super

Discover how your super fund can help protect your family

You know your super is a tax-effective home for your investments. But did you know it could also help save you money on insurance?

By taking out death and disability insurance inside super, you may be able to use your before-tax income to pay your premiums – potentially reducing the effective cost of your cover by your marginal tax rate.

These tax savings could help you:

- boost your level of cover cost-effectively, or

- reduce how much you’re paying for your insurance.

Is insurance inside super right for you?

There are some different rules and regulations when taking out insurance inside super, and it may not be suitable everyone. But it’s worth taking the time to explore your options.

- Convenience. You can pay your insurance premiums conveniently straight from your super account.

- Cashflow. Because you’re spending your super, you don’t necessarily have to find additional money in the budget to fund your insurance premiums.

- Tax effectiveness. The super environment offers a tax-effective way to hold insurance.

What are the advantages of holding life insurance inside super?

- Firstly, it’s convenient. You can pay your insurance premiums conveniently straight from your super account – so you don’t have to worry about receiving bills or forgetting to renew your cover.

- Secondly, it doesn’t affect your cashflow. You’re spending your super, so you don’t necessarily have to find additional money in the budget to fund your insurance premiums. However, you should be aware that you are reducing your retirement benefits if you don’t make additional contributions to super.

- Thirdly, there are some potential tax savings in the super environment that you can’t get when you hold your insurance outside super, which I will be covering shorty.

There are several ways you are able to pay your insurance premiums:

- You can use superannuation savings you have already accumulated. This involves no additional cost to you, but you should bear in mind it will reduce your retirement benefits.

- You can use your employer’s Superannuation Guarantee (SG) contributions – which is the compulsory 9% (increasing to 12% over time) of your income your employer pays into your super fund each year. Again, this involves no additional cost to you, but it will reduce your retirement benefits.

- If you’re an employee, you may be able to make salary sacrifice contributions. This may be able to help you top-up your super so you’re not eating into your retirement savings when you pay for insurance. However, again you need to be careful of those contribution caps I mentioned before. I’ll show you an example of this later.

- If you’re self-employed e.g. not an employee or substantially self-employed (10% rule), you may be able to make personal deductible super contributions and claim a tax deduction for this amount (subject to meeting certain conditions which we can discuss). Like a salary sacrifice arrangement, this

Case Study

After talking to his financial adviser, Cameron estimates he needs $1.2 million in combined Death and TPD cover to help the family eliminate their $500,000 mortgage and provide for any additional spending needs if he’s permanently disabled or dies.

Because Cameron has named his wife as his sole beneficiary, she would be able to receive the lump-sum insurance benefit tax-free* – so holding the insurance inside super won’t have any negative tax consequences. The payment could also be made as an ongoing income stream to his wife. However, tax may be payable on the income stream payments or a combination of a lump sum and income stream.

So what’s the strategy?

Cameron’s adviser suggests he take out his insurance inside super to make it more tax-effective. The cost of this cover is $2,000 p.a.

Rather than eat into Cameron’s retirement savings, the adviser recommends Cameron arranges to salary sacrifice $2,000 p.a. from his before-tax income to pay his premiums.

He can do this because he’s currently not making any additional contributions to super, so he has plenty of room in his concessional contributions cap.

* Based on marginal tax rate and medicare levy of 38.5%

What’s the outcome?

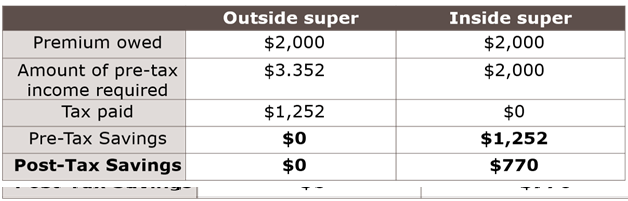

If Cameron was paying for this insurance outside super, he’d be needing to earn $3,306 before tax to clear $2,000. But because Cameron is putting before-tax income straight into super, and because he’s receiving a tax offset for the 15% contributions tax, every cent of Cameron’s $2,000 contribution effectively goes towards the insurance.

This helps Cameron achieve a tax saving of $1,252.

This tax saving could be paid as salary, which would put an extra $770 in Cameron’s pocket after tax. Or it could be used to make a super contribution, which would add an extra $1,064 in Cameron’s super fund (after 15% contributions tax).

This information is current at May 2013 but may be subject to change. Updated information will be available

free of charge by contacting Client Services.

The information provided is of a general nature and does not take into account your personal needs, financial circumstances or objectives. The case studies are for illustrative purposes only and do not constitute financial or tax advice. They assume $100,000 and $200,000pa (respectively) is the only source of taxable income based on 2013/14 tax rates and the figures do not include other tax offsets. Before acting on this information, you should consider the appropriateness of the information, having regard to your needs, financial circumstances and objectives. You should read the relevant PDS available at onepath.com.au/member and consider whether that product is right for you before making a decision to acquire or continue to hold the product. The information in this brochure has been prepared as a guide only and does not represent tax advice. Please see your adviser for advice taking into account your individual circumstances.

* Based on marginal tax rate and medicare levy of 38.5%

What’s the outcome?

If Cameron was paying for this insurance outside super, he’d be needing to earn $3,306 before tax to clear $2,000. But because Cameron is putting before-tax income straight into super, and because he’s receiving a tax offset for the 15% contributions tax, every cent of Cameron’s $2,000 contribution effectively goes towards the insurance.

This helps Cameron achieve a tax saving of $1,252.

This tax saving could be paid as salary, which would put an extra $770 in Cameron’s pocket after tax. Or it could be used to make a super contribution, which would add an extra $1,064 in Cameron’s super fund (after 15% contributions tax).

This information is current at May 2013 but may be subject to change. Updated information will be available

free of charge by contacting Client Services.

The information provided is of a general nature and does not take into account your personal needs, financial circumstances or objectives. The case studies are for illustrative purposes only and do not constitute financial or tax advice. They assume $100,000 and $200,000pa (respectively) is the only source of taxable income based on 2013/14 tax rates and the figures do not include other tax offsets. Before acting on this information, you should consider the appropriateness of the information, having regard to your needs, financial circumstances and objectives. You should read the relevant PDS available at onepath.com.au/member and consider whether that product is right for you before making a decision to acquire or continue to hold the product. The information in this brochure has been prepared as a guide only and does not represent tax advice. Please see your adviser for advice taking into account your individual circumstances.